2023 RESIDENTIAL PROPERTY MARKET OUTLOOK

- Herbert Benard

- Jan 9, 2023

- 12 min read

Updated: Jan 12, 2023

SUMMARY

The Singapore residential property market has been remarkably resilient in 2022, keeping its momentum in price growth in both private housing and the HDB resale flat segments. While underlying housing demand generally remained healthy, the limited stock of new launches and resale homes available for sale have crimped transaction volumes. Meanwhile, the residential rental market continued to surprise on the upside with strong rental growth amid persistent demand drivers and tight rental supply.

Despite the strength of the market – with new launches achieving robust take-up rates in 2022 at benchmark prices – sentiment had turned cautious, owing to growing uncertainties, rising interest rates, geopolitical tensions, and global headwinds. Central banks in many advanced economies undertook aggressive rate hikes to tame decades-high inflation, led by the US Federal Reserve which delivered four mega hikes of 75bps in the year. These have raised borrowing cost and mortgage rates.

In Singapore, the 3-Month Singapore Overnight Rate Average (SORA) which is used by banks to price home loan packages raced from 0.1949 % p.a. on 4 January 2022 to 3.0925% p.a. as at 12 December 2022. The rising interest rates prompted the government to introduce new cooling measures in September 2022 to encourage homebuyers to be more prudent with their property purchase. Government land sales tenders also showed signs of wariness among developers with less active participation and more moderate land bids.

The new cooling measures are mainly targeted at the public housing sector: a new 15-month wait-out period for private home owners who have sold their private property before they can buy an HDB resale flat [an exception for seniors who can buy 4-room or smaller resale flats]; as well as a new 3% interest rate floor and lowered loan-to-value limit to 80% for those taking HDB loans. Meanwhile, the medium-term interest rate used to compute the total debt servicing ratio has been revised from 3.5% to 4%.

In 2023, downside risks persist, including high inflation, the prospect of further monetary policy tightening, geopolitical tensions and rising costs. There are also mounting concerns over slowing economic growth and a global recession. However, the Singapore residential property sector is expected to be relatively stable, supported by the underlying demand for homes and healthy market fundamentals.

MARKET OUTLOOK

The Singapore economy is projected to expand by around 3.5% in 2022 and 0.5% to 2.5% in 2023, the Trade and Industry Ministry said in November. Barring a worsening of economic conditions, PropNex remains optimistic about the Singapore residential property market in 2023.

Although interest rates are likely to remain elevated, the pace of increase could slow and potentially plateau in the second half of 2023, particularly if central banks are able to bring inflation under control. The stabilisation of interest rates will offer greater certainty to would-be home buyers, who will have more options in 2023 - with more than 12,000 new private homes (including executive condominiums) likely to be launched for sale during the year. Meanwhile, the HDB resale market is projected to remain healthy, as it is supported by a larger demand pool of Singaporean households.

By and large, the financial position of Singapore households remains strong and the macroprudential measures that have been put in place over the years have ensured that home owners are not overleveraged. That being said, the high inflation and rising cost of living could erode consumers’ disposable income, while the more subdued economic outlook may induce more caution among property buyers. Well-located and realistically priced mass market homes should garner healthy buying interest among owner occupiers and HDB upgraders.

Singapore’s status as a global business and wealth management hub as well as its reputation as a safe haven have kept the country on the radar of global investors. Singapore saw a record $448 billion inflow of new money in 2021, according to the Monetary Authority of Singapore. The country will remain attractive to investors and the real estate sector will be a beneficiary of such capital inflows. In particular, residential projects in the city and city fringe would appeal to foreign buyers.

Looking beyond the cyclical headwinds, the Singapore residential property market remains a sound investment proposition for the long-term, owing to the country’s stable political environment, urban rejuvenation plans, industry transformation roadmaps to drive economic growth, efforts at attracting global talent and multinational corporations to the city-state, and rising affluence among a large segment of the population.

PRICE PROJECTION

SALES PROJECTION

PRIVATE RESIDENTIAL PROPERTY MARKET

Overview

In 2022, private home prices hit a new peak amidst higher benchmark prices at new launches and dwindling inventory of unsold stock. Resilient buyer demand helped to support prices despite rising interest rates and inflation.

Home Prices and Projections

• Private home prices have climbed by 8.2% in the first three quarters of 2022; PropNex expects private home values to rise by 9% to 10% for the full year 2022. By regions, the prices of non-landed homes in the Outside Central Region (OCR) grew the fastest, rising by 12.2% in the first three quarters of 2022 from end-2021. The increase was fuelled by new bench- mark prices at major suburban new launches.

• Buyers continued to find value in city centre and city fringe homes as prices of mass market homes rise. Prices of non-landed homes in the Core Central Region (CCR) and Rest of Central Region (RCR) posted modest growth in 9M 2022, despite the higher ABSD for foreign buyers and property investors, following the cooling measures introduced in December 2021. CCR and RCR prices rose by 4.1% and 6.4% respectively in 9M 2022 from end of 2021.

• Owing to global headwinds and high interest rates, the growth in private home prices in 2023 is expect- ed to moderate, rising at a slower pace of 5% to 6%.

• With more project launches in the RCR in 2023, PropNex estimates that home prices in the city fringe could grow by 6% to 8%, partly driven by higher land prices paid by developers. CCR home prices should see some upside with several CBD launches in the pipeline. Meanwhile, OCR home prices may grow at a slower pace, having chalked up substantial gains in 2022.

New Home Sales Market

• Developers sold nearly 7,000 new private homes (ex. Executive Condos) in the first 11 months of 2022 – normalising from the 13,000 units sold in 2021 due to fewer new launches during the year and depleting unsold inventory.

• The sales momentum in the new launch market was driven mainly by several OCR and RCR launches namely, Lentor Modern, AMO Residence, Piccadilly Grand and Liv @ MB.

• Due to the dwindling supply of new mass market homes, most project launches in 2022 fared well, achieving more than 70% take-up – fuelled by demand from upgraders and owner -occupiers.

• RCR projects dominated new home sales in 2022 - accounting for 39% of new homes sold. This was followed by the OCR (35%) and the CCR (26%).

• The top selling project of 2022 was Lentor Modern, selling 518 out of 605 units at a median price of $2,106 psf.

• In terms of buyer profile, Singaporeans and Singapore Permanent Residents (PRs) made up 93% of the non-landed new home sales in 2022. Meanwhile, the proportion of new non-landed homes purchased by foreigners rose to 7% in 2022 from 4% in 2021.

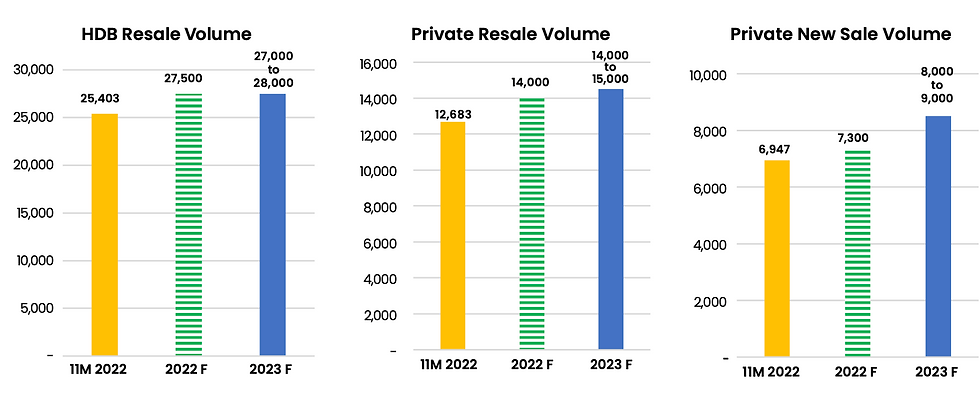

• In 2022, PropNex projects that new private home sales will likely exceed 7,300 units (ex. ECs); while in 2023, new sales volume may increase slightly to 8,000 to 9,000 units (ex. ECs) in view of the ample launch pipeline.

Inventory and Future Launches • As at the end of Q3 2022, the inventory of unsold new homes stood at 15,677 units (ex EC).

• The unsold stock in the CCR, RCR, and OCR stood at 5,681, 6,579, and 3,417 units respectively. The unsold stock in the OCR as of Q3 2022 marks a historic low for the sub-market.

• In 2023, a larger supply estimated at about 12,000 new units (incl. EC) may be launched – with over 5,200 units in the city fringe (RCR), 4,400 units in the suburbs (OCR) and 2,500 units in the city (CCR).

• Project launches in the RCR are expected to lead the market with new average benchmark prices, owing to the higher land cost for sites acquired at recent state tenders, e.g. Dunman Road, Jalan Tembusu, and Pine Grove.

• CCR new launch prices could also climb in view of more city centre projects lined up - most are mixed-use or integrated developments, such as Marina View, 8 Shenton Way and TMW Maxwell.

• Meanwhile, prices of suburban (OCR) new homes will likely remain firm, grow slightly from 2022’s pricing. Upcoming launches in 2023 include Scene- ca Residence, Lentor Hills Residences, and Dairy Farm Walk.

Private Resale Market and Outlook • The secondary market did modestly well in 2022, with more than 13,000 units resold in the first 11 months of 2022 (Resale: 13,084 units; Subsale: 673 units).

• The most popular districts in the resale market included District 19 and District 15, which chalked up more than 1,300 and 1,000 deals respectively in the first 11 months of 2022; these are popular areas amongst locals and HDB upgraders.

• In terms of transaction value, resale homes in the prime District 10 recorded $2.87 billion worth of deals.

• In 2023, the resale volume could hit between 14,000 and 15,000 units - with more supply completions entering the market.

• A bumper crop of 18,000 private homes (ex. EC) are expected to be completed in 2023 which should contribute to the resale stock and help to prop up overall resale prices.

Landed Housing • After a banner year of sales in 2021, the landed resale market cooled down significantly in 2022. Nearly 2,000 landed homes changed hands in 2022 – the bulk of sales being terrace homes. The total value of landed homes sold in the first 11 months of 2022 amounted to more than $10 billion.

• Detached houses formed the smallest share of deals (222 caveats lodged) with a combined trans- action value of more than $2.99 billion (or 30% of sales values). Sales of detached homes have slowed following a strong year of sales in 2021, particularly driven by GCB deals.

• Based on URA Realis caveats data, there were 41 GCBs (detached homes in GCB Areas) sold in the first 11 months of 2022, amounting to over $1.1 billion in value – down from 2021’s record $2.55 billion.

• Given the geopolitical uncertainties in some parts of the world, many high net worth individuals and the ultra-rich have relocated to Singapore in 2022. GCBs remain a coveted residential asset among wealthy Singaporeans and new citizens.

• In 2023, the sales momentum of landed homes and GCBs is expected to soften further due to a limited supply of landed homes available for sale – though demand will be sustained by the ultra-rich families looking for a home to call their own.

HBD RESALE MARKET

Overview The HDB resale market remained resilient in 2022, with more than 24,000 units resold in the first 11 months of 2022. Meanwhile, HDB resale prices are expected to post another year of double-digit growth.

The economic recovery, delays in the completion of new BTO flats, and a large supply of flats exiting the minimum occupation period (MOP) were all factors that have contributed to driving sales and price growth in 2022.

Transaction and Prices

• As of Q3 2022, the HDB resale price index has grown by nearly 8% from the end of 2021.

• By flat type, the average resale price of 3-room HDB resale flats rose from 2021 to 2022 to $388,000, while that of 4-room and 5-room HDB resale flats increased to $548,000 and $654,000 respectively.

• An estimated 31,325 flats have completed their 5-year MOP in 2022, possibly injecting fresh supply of units to the resale/rental market. In 2023, about 15,700 HDB flats are likely to attain MOP – substantially lower than the MOP stock in 2022.

• The HDB estates that clocked the most resale trans- actions in 2022 were in non-mature towns such as Sengkang, Yishun, and Punggol – more than 2,100 flats in Sengkang were resold in the first 11 months of the year – being popular among home buyers due to their more affordable pricing and a wider selection of units.

Million-Dollar HDB Resale Transactions

• In the first 11 months of 2022, more than 340 HDB flats were resold for at least $1 million – already surpass- ing the record 259 deals done in the whole of 2021. Most of these million-dollar flats are either located in prime mature estates or have fairly large floor areas which contributed to their hefty price tags. The HDB towns of Central Area, Bishan, Toa Payoh and Bukit Merah had the highest number of million-dollar resale flat deals in 2022. The most expensive resale flat sold in 2022 was a 5-room flat at SkyTerrace @ Dawson that went for $1.418 million in July.

HDB Resale Market Outlook • Despite the recent cooling measures – aimed at encouraging home buyers to be more prudent with property purchase amid high interest rates – HDB resale prices are not likely to see a significant downward correction, as the tight resale stock and stable demand will help to keep prices relatively steady. PropNex projects HDB resale prices could rise by 9% to 10% for the whole of 2022, slowing from the 12.7% growth in 2021.

• The temporary 15-month wait-out period introduced as part of the latest cooling measures will moderate demand for larger flats, especially flats in prime locations. For first-timer buyers, this helps to level the playing field by easing demand from private home downgraders, who tend to have a greater financial ability to pay a higher price for resale flats.

• In 2023, HDB resale prices may grow at a slower pace following two years of robust performance. Together with the cooling measures and some price resistance setting in, this may slow the pace of the overall price increase. PropNex forecasts that HDB resale prices may grow by 6 to 8% in 2023.

• With fewer MOP flats entering the market in 2023 compared to 2022, the available stock for resale could remain tight. PropNex expects the HDB resale volume to come in at around 27,000 to 28,000 flats in 2023. Demand will continue to be driven by those with more pressing housing need as well as families who do not wish to wait 3-5 years to get a BTO flat. Notably, eligible first-time buyers can also receive up to $160,000 in housing grants from the government, making HDB resale units attractive to Singaporean households.

RESIDENTIAL LEASING MARKET

Overview In 2022, a landlord’s market took hold as the leasing • market saw unprecedented growth owing to strong leasing demand from various segments amid the tight rental stock in the market. Delays in the completion of new condos and BTO flats also played a part in crimping condo rental stock and boosting demand for rental housing.

Demand drivers that have helped to push up rents include those waiting for their new homes to be completed due to Covid-19 construction delays; return of foreign employment on economic recovery and reopening of borders; HDB upgraders who have sold their flats to avoid paying ABSD when they purchase a new launch condo; and people renting larger apartments to have more privacy and space with the wider adoption of hybrid working.

RESIDENTIAL LEASING MARKET

• As of the end of Q3 2022, the URA Rental Index of private residential homes has grown by a whopping 20.8% over the past year amid a strong landlord’s market and fierce competition amongst tenants for rental accom- modation.

• Limited rental stock and new stock completions have curtailed leasing volume in 2022. Based on transaction data, there were over 75,000 rental contracts for private homes (ex. ECs) between January and October 2022. PropNex expects the total number of leasing contracts could cross 90,000 – lower than the 98,600 transac- tions in 2021.

• In terms of rental value, leasing contracts in the first 10 months of 2022 amounted to $353.6 million, and is projected to cross $400 million for the full year.

HDB Flat Leasing

For the HDB leasing market, nearly 28,000 rental transactions were done in the first 9 months of 2022. PropNex anticipates that some 36,000 transactions may be done in 2022, markedly lower than previous years. The stronger HDB resale activity in 2021 could have contributed to fewer units available for rent. Under HDB rules, a resale flat buyer will not be able to rent out the unit till after the 5-year MOP.

• Besides tenants who are renting for interim housing due to COVID-related delays in constructions and renovations, another key demand driver of HDB flat leasing was tenants who were priced out of the private residential leasing market.

• Rentals of HDB flats have grown by over 20% in 2022 - keeping pace with that of private home rentals – as demand continued to stay elevated.

Leasing Market Outlook • Looking at 2023, PropNex does not anticipate that the government would introduce measures to cool the home leasing market. Oncoming new completions in 2023 will add to rental supply and could help to potentially rein in rental growth , leading to a more stable leasing market perhaps in the second half of 2023.

• Home leasing activity is not expected to slow significantly in view of the persistent demand drivers and this will lend support to rentals.

• Some challenges for the leasing market include the potential impact of a global recession, slower business expansion, and retrenchments which could impact leasing demand. Deteriorating business outlook may also affect hiring and could crimp corporate housing budget for foreign expatriates.

Disclaimer: While every reasonable care is taken to ensure the accuracy of information printed or presented here, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The ideas, suggestions, general principles, examples and other information presented here are for reference and educational purposes only. This publication is not in any way intended to give investment advice or recommendations to buy, sell or lease properties or any form of property investment. PropNex shall have no liability for any loss or expense incurred, relating to investment decisions made by the audience. All copyrights reserved.

Comments